springfield mo sales tax rate 2020

Statewide salesuse tax rates for the period beginning july 2021. The december 2020 total local sales tax rate was also 8100.

Georgia Sales Tax Rates By City County 2022

The base sales tax rate is 81.

. The item tax code listed under each rate column is the 4 digit suffix of the Jurisdiction Code for the type of tax rate displayed Missouri Department of Revenue Run Date. Statewide salesuse tax rates for the period beginning July 2020. The states sales tax is imposed on the purchase price of tangible personal property or taxable service sold at retail.

102020 - 122020 - PDF. The december 2020 total local sales tax rate was also 8100. Statewide salesuse tax rates for the period beginning October 2021.

Each tax rate ceiling is determined annually and is adjusted to ensure revenue neutrality. This includes state sales tax of 4225 the city sales tax of 2125 and the county sales tax rate of 175. The December 2020 total local sales tax rate was also 8100.

Subtract these values if any from the sale. Ad Lookup Sales Tax Rates For Free. For state use and local taxes use state and local sales tax calculator.

Exact tax amount may vary for different items. You can print a 81 sales tax table here. The missouri state sales tax rate is 423 and the average mo sales tax after local surtaxes is 781.

There is no applicable special tax. This page will be updated monthly as new sales tax rates are released. 5000 Total gross receipts collected by hotel.

Statewide salesuse tax rates for the period beginning October 2020. Qualifying food drugs vehicles and medical appliances are exempt from this tax. The current total local sales tax rate in springfield mo is 8100.

Whether the proposed rates comply with Missouri law. This is the total of state county and city sales tax rates. 072021 - 092021 - PDF.

Over the past year there have been 73 local sales tax rate changes in Missouri. Springfield MO Sales Tax Rate Springfield MO Sales Tax Rate The current total local sales tax rate in Springfield MO is 8100. Use this calculator to estimate the amount of tax you will pay when you title your motor vehicle trailer all-terrain vehicle ATV boat or outboard motor unit and obtain local option use tax information.

The missouri state sales tax rate is 423 and the average mo sales tax after local surtaxes is 781. The citys finance director David. Boost your business with wix.

KY3 - The city of Springfield says its latest sales tax check is more than 1 million over budget. Room Rate Sales Tax Charged x 0526 Total gross x 005. The 81 sales tax rate in Springfield consists of 4225 Missouri state sales tax 175 Greene County sales tax and 2125 Springfield tax.

This table lists each changed tax jurisdiction the amount of the change and the towns and cities in which the modified tax rates apply. Springfield Missouri Sales Tax Rate 2021 - Avalara. Statewide salesuse tax rates for the period beginning November 2020.

The new tax will start on april 1st. The December 2020 total local sales tax rate was also 8100. Interactive Tax Map Unlimited Use.

This is the total of state county and city sales tax rates. The Springfield sales tax rate is. Consumption at the rate of 25.

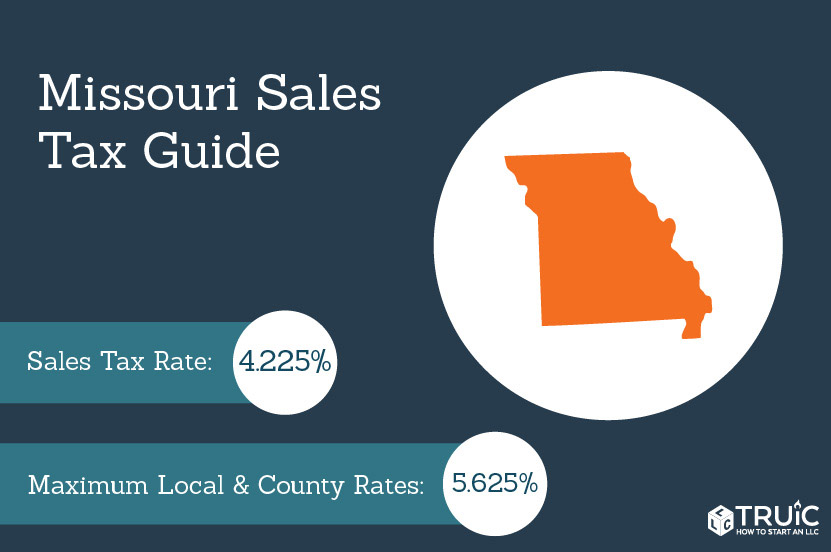

The Missouri state sales tax rate is 423 and the average MO sales tax after local surtaxes is 781. Collector of Revenue Allen Icet 940 N Boonville Ave Room 107 Springfield MO 65802 417 868-4036 collectorhelpgreenecountymogov. What is the sales tax rate in springfield missouri.

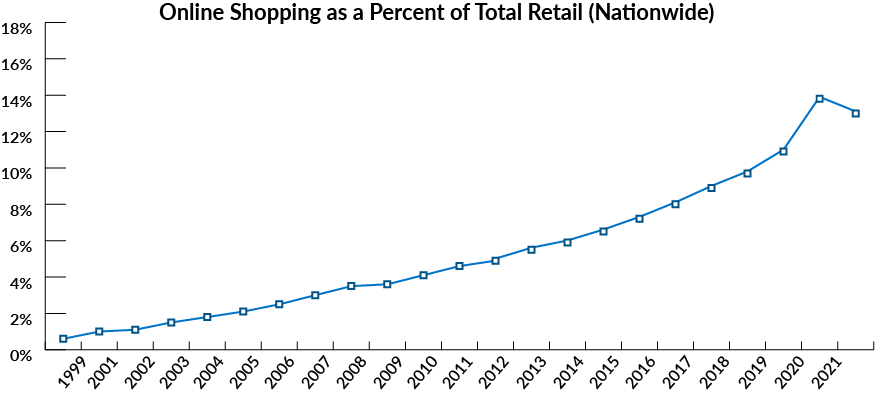

Springfield need to raise the sales tax rate. 31 rows With local taxes the total sales tax rate is between 4225 and. 2022 Missouri state sales tax.

Statewide salesuse tax rates for the period beginning July 2021. The 4225 percent state sales and use tax is distributed into four funds to finance portions of state government General Revenue 30 percent. The minimum combined 2022 sales tax rate for Springfield Missouri is.

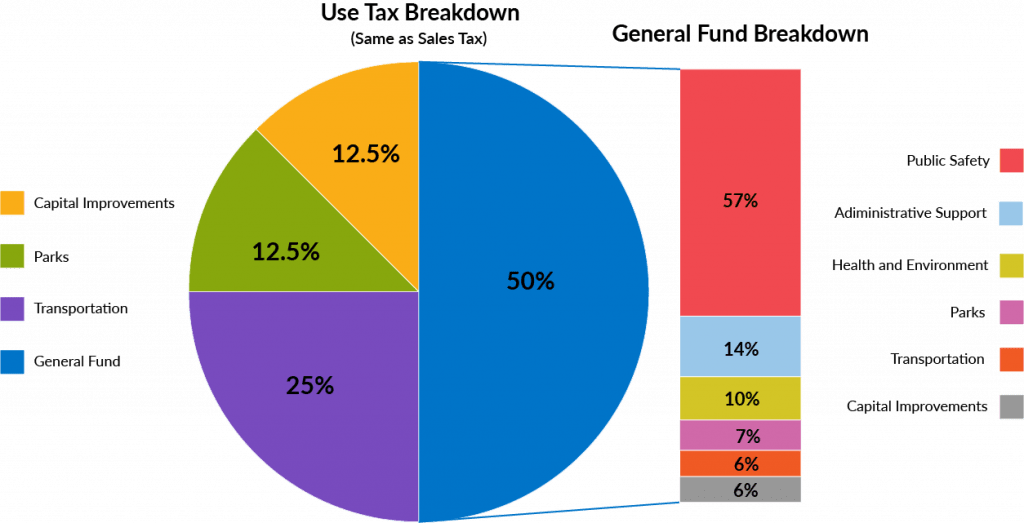

The city sales tax rate of 2125 includes a 1-cent General Sales Tax 14-cent sales tax for capital improvements 18-cent Transportation Sales Tax and 34-cent Pension Sales Tax. The 2020 tax rate ceilings were determined based on the requirements of Section 137073 RSMo and Missouri Constitution Article X Section 22 commonly referred to as the Hancock Amendment. Amount of tax hotel pays to City.

Use tax is imposed on the storage use or consumption of tangible personal property in this state. 052020 - 062020 - PDF. State Sales Tax - imposed on a sellers receipts from sales of tangible personal property for use or consumption at the rate of 625 The City receives 16 of the 625.

The missouri sales tax rate is currently. 042021 - 062021 - PDF. You pay tax on the sale price of the unit less any trade-in or rebate.

11 2020 at 604 PM PDT. The Missouri sales tax rate is currently. The current total local sales tax rate in Springfield MO is 8100.

072020 - 092020 - PDF. This tax is imposed on general merchandise. What is the sales tax rate in Springfield Missouri.

240 People Used More Offers Of Store Visit Site. Statewide salesuse tax rates for the period beginning May 2021. 6152020 Taxation Division TA0300 Sales and Use Tax Rate Tables Display Only Changes.

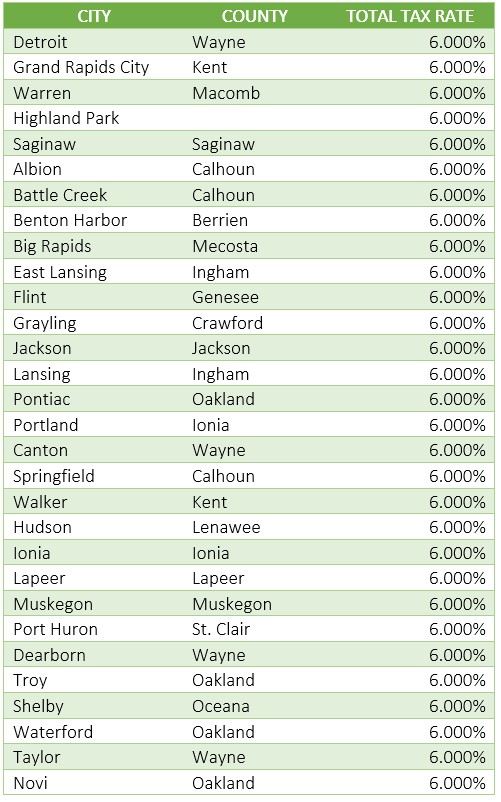

Did South Dakota v. For tax rates in other cities see Missouri sales taxes by city and county. 56ij State County City Sales Tax.

Food 4 less springfield mo springfield mo. The county sales tax rate is. Counties and cities can charge an additional local sales tax of up to 5125 for a maximum possible combined sales tax of 9355.

The County sales tax rate is. Room Rate x 00 ôí Hotel Tax passed on to customer. The springfields tax rate may change depending of the type of purchase.

052021 - 062021 - PDF.

Sales Taxes In The United States Wikiwand

Sales Taxes In The United States Wikiwand

Missouri Sales Tax Rates By City County 2022

Monthly Financial Reports Springfield Mo Official Website

Louisiana Sales Tax Rates By City County 2022

Ohio Sales Tax Rates By City County 2022

Use Tax Web Page City Of Columbia Missouri

Virginia Property Tax Calculator Smartasset

Sales Taxes In The United States Wikiwand

Missouri Income Tax Rate And Brackets H R Block

Taxes Springfield Regional Economic Partnership

Sales Taxes In The United States Wikiwand

Sales Taxes In The United States Wikiwand

Colorado Sales Tax Rates By City County 2022

Missouri Sales Tax Small Business Guide Truic

U S States With Highest Gas Tax 2022 Statista